San Miguel County

Foreclosure Information

San Miguel Regional Housing Authority (SMRHA) administers deed restricted programs for the Town of Telluride, San Miguel County and Town of Mountain Village. Each jurisdiction offers housing programs for qualified local employees to rent or purchase.

1. Early Intervention is Your Best Way to Save Your Home from Foreclosure

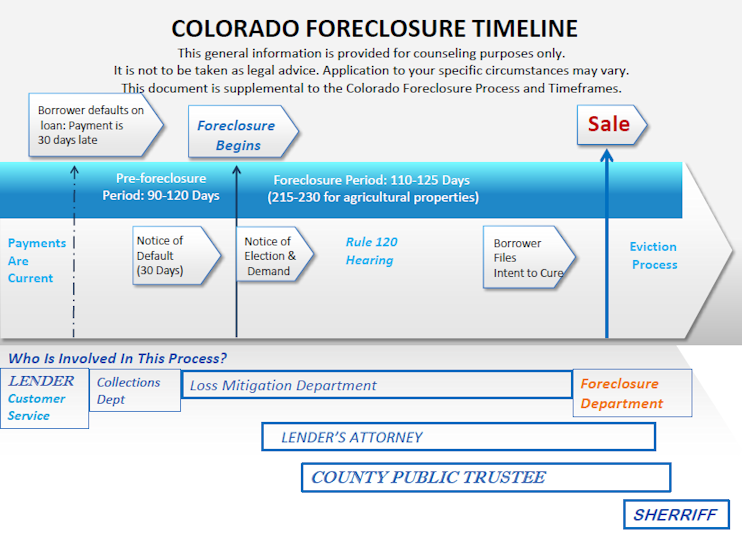

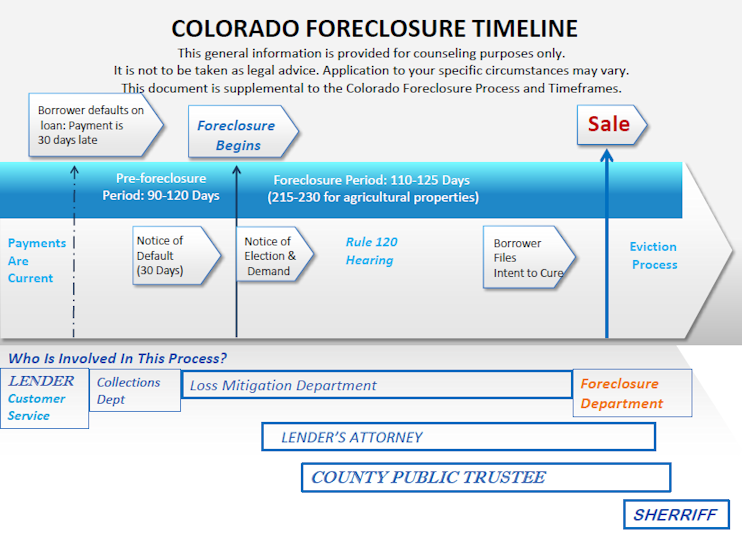

Please see the timeline for details on how foreclosure works in the state of Colorado.

2. Be Informed and Act Quickly

There are many reasons a household may have difficulty paying a mortgage: unexpected expenses, unemployment, overspending, illness/injury, death, divorce, relocation, birth or addition of a child, education expenses, and others. Whatever the reason, get informed about all of the options and act quickly.

- A clear Statement of the Problem;

- A thorough Personal Financial Statement; and

- A realistic Plan of Action, spelling out for the lender the relief you are seeking and how you plan to meet your current and future financial obligations.

Foreclosure intervention involves addressing the financial crisis in the earliest possible stages to maximize relief available from the lender.

3. Download and Complete the 3 Forms Below

This sheet will help you identify your priorities, evaluate your financial situation, and determine a realistic payment solution.